An FHA loan is a government-backed mortgage designed to help borrowers with lower credit scores or limited savings qualify for home financing. Though private lenders issue these loans, the Federal Housing Administration (FHA) insures them, meaning the FHA guarantees a portion of the loan in case of borrower default. This reduced risk encourages lenders to offer more flexible qualification requirements, making FHA loans ideal for first-time buyers and those with financial challenges.

Top FHA Loan Benefits

3.5% minimum down payment requirement

Lower interest rates than conventional loans

500 credit score minimum (with 10% down payment)

580+ credit score minimum (with 3.5% down payment)

Flexible debt-to-income (DTI) ratio requirement

Are FHA loans only for first-time buyers?

FHA loans are not limited to first-time buyers. FHA home loans are available to all types of homebuyers, whether they currently own a home or are entering the homeowner market for the first time. In fact, FHA loans can be a great option for buyers with credit blemishes, higher debt-to-income ratios, or other hurdles that may make it challenging to get approved for a conventional loan.

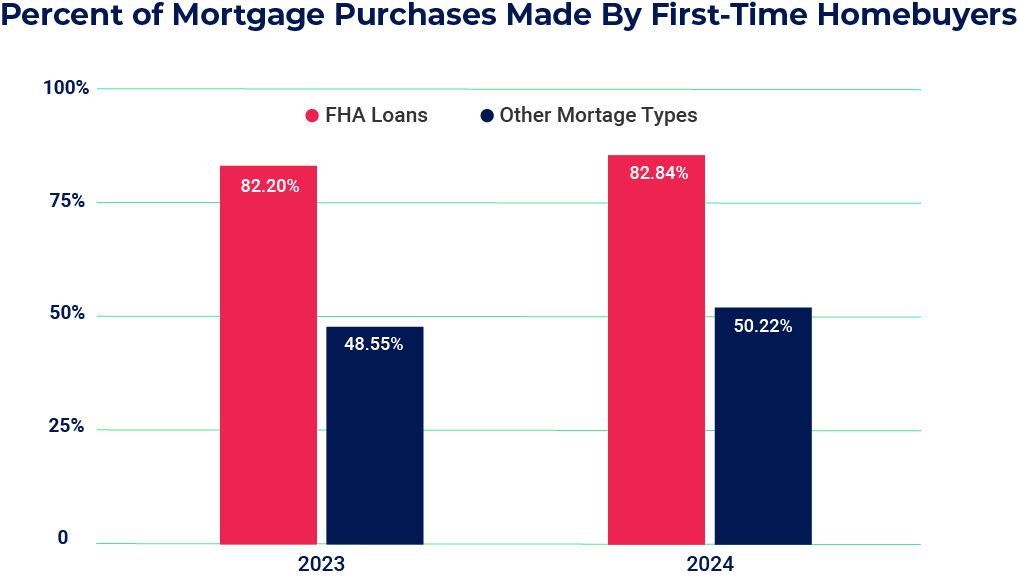

According to the latest data, almost 83% of FHA borrowers in 2024 were first-time homebuyers, whereas first-time homebuyers only accounted for around 50% of purchases for other mortgage types.

*Data Source: The Federal Housing Administration’s 2024 Annual Report.

The easier qualifications for FHA loans make them attractive to first-time homebuyers, who may be unable to come up with the down payment needed for a conventional loan.

Other home loan options, such as a conventional loan, can require down payments as high as 20%, which is a considerable difference.

FHA Loan vs. Conventional Loan

| FHA Loans | Conventional Loans | |

|---|---|---|

| Credit Score | As low as 500* (with 10% down payment) | At least 620, although many lenders require higher |

| Down Payment | As low as 3.5% | 3% to 20% |

| Mortgage Insurance | Required for all buyers | Required if down payment is less than 20% |

| Insurance Premiums | Upfront: 1.75% of the loan Annual: 0.55% to 0.75% | Varies from 0.5% to 1% of the loan, paid annually until reaching 80% equity in the home |

| Loan Limits | Yes, but lower than conventional limits | Yes |

| Availability of Down Payment Assistance Programs | Yes | No |

FHA vs. Conventional Loan Limits

FHA and conventional loans both have loan limits, but FHA loan limits are typically lower.

Loan limits are the maximum amount a borrower can finance with a specific loan type set by government agencies or secondary market investors.

Let’s take a look at the average 2025 conventional and FHA loan limits:

2025 FHA and Conventional Standard Loan Limits

| Standard Limit | Standard Limit in High-Cost Areas | Limit in Alaska, Hawaii, Guam, & U.S. Virgin Islands | |

|---|---|---|---|

| 2025 FHA Loan Limits | $524,225 | $1,209,750 | $1,814,625 |

| 2025 Conventional Loan Limits | $806,500 | $1,209,750 | $1,209,750 |

FHA loan limits vary by county and are based on local home prices, while conventional loan limits, set by the Federal Housing Finance Agency (FHFA), apply nationwide with adjustments for high-cost areas. Loans exceeding these limits are considered jumbo loans and may have stricter qualification requirements.

Types of FHA Loans

Another great benefit of FHA loans is that there are many different loan types aimed at serving borrowers with different purchase or refinancing needs. These include:

FHA Purchase Loans

These types of FHA loans are used to finance your primary residence — and are what most homebuyers opt for when using an FHA loan.

FHA Streamline Refinance

FHA Streamline Refinance loans are a type of refinance loan available to homeowners with FHA loans already. These loans can lower an FHA loan's interest rate, reduce monthly payments, or shorten a loan term without going through the home appraisal process.

FHA Cash-Out Refinance

An FHA Cash-Out Refinance loan is a loan that lets homeowners refinance their FHA loans for up to 80% of their home’s value in order to cash out equity. An FHA Cash-Out Refinance loan replaces your current loan with a new loan that includes the total amount borrowed from the equity plus the remainder of the balance on the original home loan.

FHA Home Equity Conversion Mortgages (HECM)

These FHA loans are only available to homeowners 62 or older and allow them to exchange some of their home equity for cash.

FHA Energy-Efficient Mortgages (EEM)

These unique types of FHA mortgages are offered to buyers who want to make energy-efficient home improvements. They offer buyers extra funds to pay for updates to make the home more energy-efficient.

FHA 203(k) Mortgages

FHA 203(k) loans are geared toward buyers who want to purchase fixer-uppers. With this type of FHA loan, you can finance both the purchase of a house and the costs of rehabbing or repairing the home into one mortgage.

Section 245(a) Loans

Low-income buyers who expect to increase their income over time can benefit from this FHA loan. This type of loan starts the buyer’s payments out small but gradually increases them over time as their earnings increase.

How to Apply For an FHA Loan

Applying for an FHA loan is easy. All you need to do is find an FHA-approved lender and meet their eligibility requirements. The application steps usually go like this:

- Check Eligibility – Ensure you meet FHA requirements, including a minimum credit score (typically 580 for a 3.5% down payment) and a debt-to-income ratio within FHA guidelines.

- Find an FHA-Approved Lender – FHA loans are offered by private lenders, such as banks and mortgage companies, that the Federal Housing Administration approves.

Paddio is an FHA lender with a 4.75/5 star satisfaction review. Get started today. - Get Preapproved – Submit financial details, including income, credit score, and employment history, to receive a preapproval letter indicating how much you can borrow.

- Choose a Home and Make an Offer – Work with a real estate agent to find a home that meets FHA property requirements and submit an offer.

- Complete the Loan Application – Provide necessary documentation, such as tax returns, pay stubs, and bank statements, to your lender for final loan approval.

- Go Through FHA Appraisal – The home must pass an FHA appraisal to ensure it meets minimum property standards and that its value matches the listing price.

- Underwriting & Close on Your Loan – Your loan will go through underwriting – either manually or through an automated underwriting system (AUS). Once approved, you’ll sign the final paperwork, pay closing costs, and get the keys to your new home.

If you're considering buying a home, an FHA loan could be the right fit for you. Check your eligibility today and take the next step toward homeownership with confidence.